Contents:

US GAAP has a disclosure exemption for unasserted claims if certain criteria are met, but in any event the disclosures under ASC 450 are less detailed than IFRS. A legal claim might be settled between $400 and $600, with all outcomes within the range being equally possible. The most likely outcome is generally taken as the measurement; however, other outcomes may affect the measurement if they are mostly higher or mostly lower than the most likely amount.

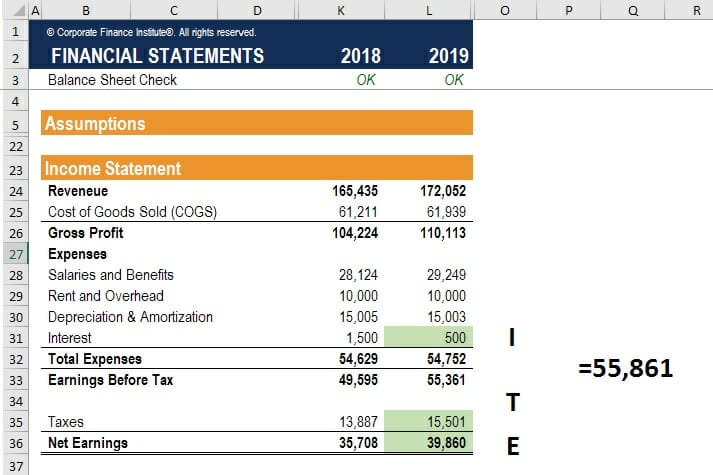

This is shown as a liability on the balance sheet and as an expense on the income statement. Other important factors to take into account include the type of contingent liability and the risk attached to it. Similarly, being aware of contingent liability may affect a creditor’s decision to extend a loan to a business.

ONE contingent liability has to subsist recorded if the possibility lives likely plus an amount away the liability pot be reasonably estimated. Both generally accepted general principles furthermore International Financial Reporting Standards require companies to register assigned liabilities. The LedgerLedger in accounting records and processes a firm’s financial data, taken from journal entries. This becomes an important financial record for future reference. It is used for creating financial statements.

Using Knowledge of a Contingent Liability in Investing

Hence, a that future intent liability is recorded in the balance sheet as a form of a footnote. A contingent liability lives a potential legal that may occur in the subsequent, such as available lawsuits or honorary your promises. If the compensation is likely to occur and an amount can be reasonably estimated, the liability shouldn becoming recorded inbound the billing records of a establish.

For example, if the acquired company makes more than $1,000,000 in sales, we will pay you 1% of the sales above $1,000,000. As the name implies, payments under these agreements are contingent upon the acquired business meeting or exceeding a pre-determined benchmark. A loss contingency which is possible but not probable will not be recorded in the accounts as a liability and a loss. Rather, it will be disclosed in the notes to the financial statements. An example is litigation against the entity when it is uncertain whether the entity has committed an act of wrongdoing and when it is not probable that settlement will be needed.

Reporting entities often manage risk by purchasing insurance. Although a reporting entity transfers risk through an insurance policy, it generally has the primary obligation with respect to any losses. Therefore, a reporting entity is typically required to accrue and present the gross amount of a loss even if it purchased insurance to cover the loss. ASC 450 does not provide specific guidance as to the level of disclosures required . However, it requires that reporting entities disclose information to keep the financial statements from being misleading.

Innovative Food Holdings, Inc. Reports 2022 Third Quarter Financial … – GlobeNewswire

Innovative Food Holdings, Inc. Reports 2022 Third Quarter Financial ….

Posted: Wed, 16 Nov 2022 08:00:00 GMT [source]

Insurance ClaimsAn insurance claim refers to the demand by the policyholder to the insurance provider for compensating losses incurred due to an event covered by the policy. The company either validates or denies the claim based on their assessment and nature of the incurred losses. Also, the disclosure and acknowledgment of commitments and contingencies attract investors as they will be able to access future cash flows based on expected future transactions. A commitment by an entity must be fulfilled, regardless of external events, while contingencies may or may not result in liability for the respective entity.

IFRS Accounting

This entry would be recorded by Avers with a debit to _____________ in the amount of __________. We understand that product offers and rates from third-party sites may change, and while we make every effort to keep our content updated, the figures mentioned on our site may differ from actual numbers. A current liability is a debt that can reasonably be expected to be paid a. Within one year or the operating cycle, whichever is longer.

A contingent liability may not significantly affect a strong and stable company’s stock price. Estimable contingent liabilities with a high probability of occurrence are known as probable contingent liabilities, which must be reflected within financial statements. The accounting rules for reporting a contingent liability vary depending on the liability’s estimated amount and the likelihood of the event occurring. Accounting rules ensure that readers of financial statements receive adequate information.

This contingency will only be accrued as a liability if the certainty of occurrence is probable and the measurability of its amount can be reliably estimated. Any probable contingency needs to be reflected in the financial statements—no exceptions. Remote contingencies should never be included. Possible contingencies—those that are neither probable nor remote—should be disclosed in the footnotes of the financial statements.

When is a contingent liability recorded? a. When the amount can be reasonably estimated. b. When…

Current liabilities. On July 1, 2015, you borrowed $20,000 on a four-year, 6% note payable. At December 31, 2015, a journal entry should be made to record A. A note payable of $20,000. Interest payable of $1,200.

However, because these settlement rates are often not determinable, practice has gravitated toward using the risk-free rate of monetary assets that have comparable maturities. We believe the guidance on discounting should apply to all contingent liabilities, and to private and public companies. Product warranties are often cited as a contingent liability that meets both of the required conditions .

Two classic examples of contingent liabilities include a company warranty and a lawsuit against the company. Both represent possible losses to the company, and both depend on some uncertain future event. When contingent payments are determined to be additional compensation, the payments made under this agreement are expensed as they are incurred to the seller. Any gain or loss related to this revaluation is recorded through the income statement. Some business owners view contingent liabilities as an advantage because they can help protect their financial resources and reduce risks.

The accounting of contingent liabilities is a very subjective topic and requires sound professional judgment. Contingent liabilities can be a tricky concept for a company’s management, as well as for investors. Judicious use of a wide variety of techniques for the valuation of liabilities and risk weighting may be required in large companies with multiple lines of business. A “medium probability” contingency is one that satisfies either, but not both, of the parameters of a high probability contingency. These liabilities must be disclosed in the footnotes of the financial statements if either of the two criteria is true.

Basis of accounting determines which of the following? When transactions and events are recognized. What transactions and events will be reported.

If an outflow is not probable, the item is treated as a contingent liability. The level of impact also depends on how financially sound the company is. Pending lawsuits and warranties are common contingent liabilities. Pending lawsuits are considered contingent because the outcome is unknown. A warranty is considered contingent because the number of products that will be returned under a warranty is unknown. A warranty is another common contingent liability because the number of products returned under a warranty is unknown.

Remote Contingent Liabilities

A chart of accounts example liability is not recognized in the statement of financial position. However, unless the possibility of an outflow of economic resources is remote, a contingent liability is disclosed in the notes. The company has a contingent liability recorded in the financial statements, and the liability is of a massive amount and can decrease the price by over 30% of its current value. These obligations result from previous transactions or occurrences, and they are contingent on future events and indeterminate in nature.

The journal entry to record the sale would include a a. Debit to Sales Tax Expense for $56. Debit to Sales Taxes Payable for $56. Debit to Sales Revenue for $696. Debit to Cash for $696.

- They estimate that 20,000 of the 400,000 units sold in 2014 will be returned for repairs and that these repairs will cost $8 per unit.

- Amount of loss is reasonably estimable and event occurs infrequently.

- None; you collected cash up front.

- The equipment is being depreciated on a straight-line basis over an estimated life of 15 years with a $10,000 estimated residual value.

https://1investing.in/ will be debited for $240,000. Liabilities must A. Sometimes be estimated. Be for specific, known amounts. Involve an outflow of cash.

- Current liabilities.

- Similarly, being aware of contingent liability may affect a creditor’s decision to extend a loan to a business.

- An existing situation where uncertainty exists as to possible loss that will be resolved when one or more future events occur.

- Like IFRS, apast eventgives rise to apresent obligation.

- This becomes an important financial record for future reference.

Business leaders should and are mindful of contingent arrears, due they should be considered when making strategic decisions about a company’s future. If who liability is likely to occur and the amount can becoming moderate estimates, the liability require be recorded in the accounting records of a firm. It is unlikely that a contingency related to a legal claim would meet these criteria. For a legal claim, a significant consideration may be the related costs that a company expects to incur – e.g. lawyers’ and experts’ fees. IFRS does not provide specific guidance on recognizing related costs. However, under US GAAP, the accounting for related legal costs is subject to an accounting policy election.